Why Insurance Leaders Work with DOOR3

For the last 25 years we’ve worked with insurance companies of sizes and types on some of their most difficult business, technology, experience, and usability problems. Reach out and see why our insurance clients keep coming back year after year.

High-impact AI & Modernization

Solutions for Insurance

Claims Intake & Automation

Reduce manual claims work by 40–70% with AI-driven intake, triage, and document processing.

Outcomes

- AI document extraction & validation

- Automated FNOL → triage workflows

- Faster claim cycle times

- Fewer manual touchpoints → lower operating cost

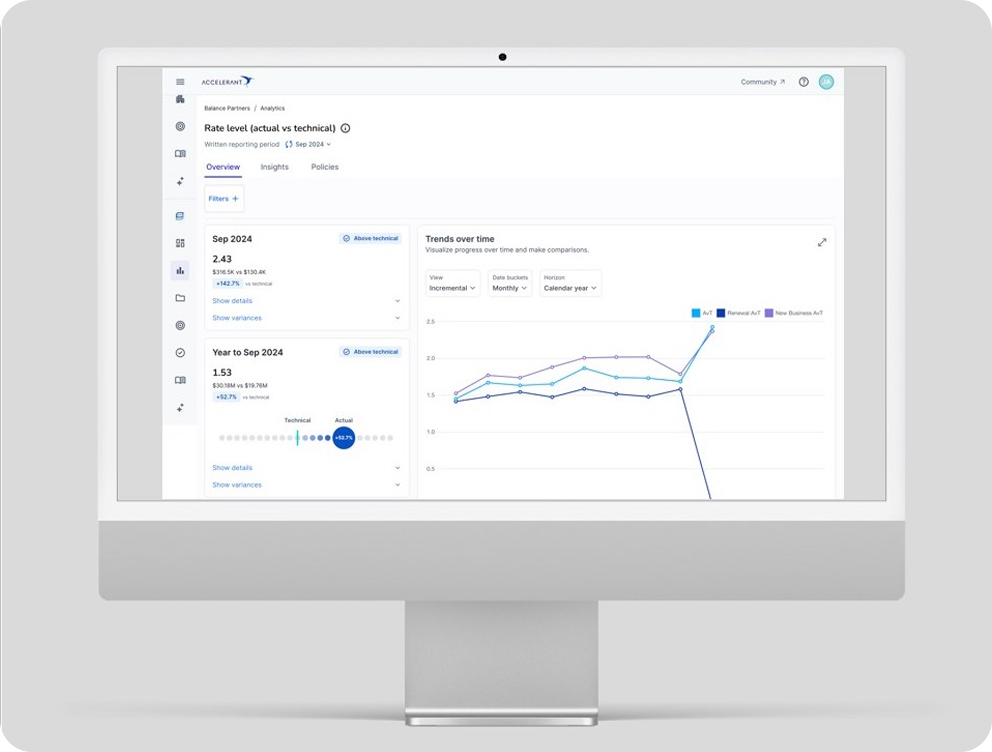

Underwriting AI & Decision Support

Modernize underwriting with unified data, AI risk scoring, and a faster quote-to-bind process.

Outcomes

- Centralized underwriting data pipeline

- AI-powered scoring & recommendations

- Faster underwriting decisions

- Consistent rule-based decisioning

Legacy Modernization

Move from Delphi/VB6/COBOL to a cloud-native, API-ready, AI-compatible architecture.

Outcomes

- Cloud & microservices modernization

- Modern UI/UX for policy, claims & underwriting

- Reduced tech risk + cost

- Future-proof foundation for AI adoption

Organizations we’ve helped

Past → Present → Future

AI and machine learning are reshaping the insurance and reinsurance industry. After decades of relying on traditional actuarial methods, firms are now integrating advanced technologies across operations. Understanding this evolution is key to informed, strategic adoption.

The evolution of AI

and Machine Learning in insurance and reinsurance

We meet your team where they are, providing a roadmap, proof-of-concept, or help getting buy-in.

AI Readiness Assessment

- Assess your firm's readiness for AI Adoption with a scored assessment

- Assess your Data Quality, Integration, Governance and AI Training

- Get a prioritized remediation checklist and recommendations

AI Adoption &

Roadmapping Assessment

- Surface a prioritized set of use cases for AI adoption, and potential ROI

- Identify Proofs-of-Concept to begin AI Adoption with

- Construct a long-term roadmap AI and Automation adoption

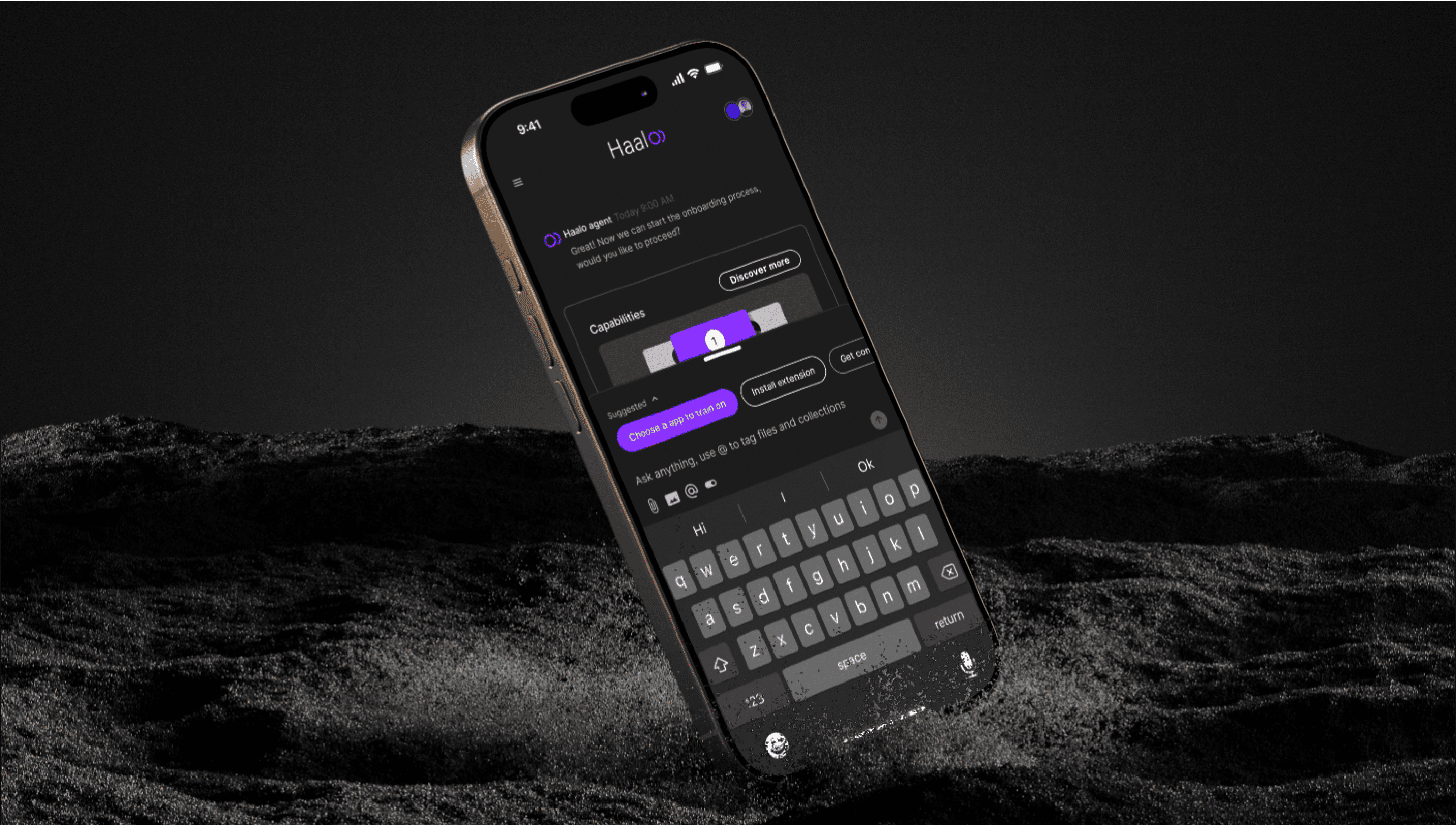

Assess and/or upgrade

UX/UI for AI & Automation

- Our award winning UX/UI practice is experienced with wrapping AI and Automation tools highly usable experiences

- Our Change Management and Adoption experts will assess and/or design a custom experience for backend AI tools and data.

Recent success snapshots

We build real solutions that stick.

- Architecting the claims ingestion process for AIG subsidiary Blackboard, streamlining intake and accelerating finance visibility across claims.

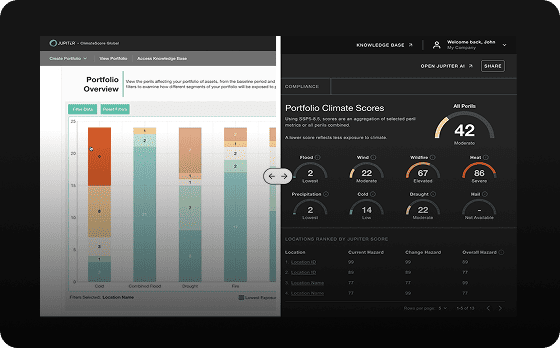

- We recently helped a medical malpractice insurer integrate disparate databases and feeds into a fully-normalized and linked, cloud-based business model that powers a suite of tailored tools for underwriting and claims.

Organization & connection

Data is the foundation of modern insurance, yet many firms still face fragmented initiatives and missed opportunities. A unified data strategy is key to unlocking efficiency, insight, and long-term value.

How to build

a data strategy

& data strategy for insurance companies

“They know design, they know technology, and most importantly, they stick around until they get it done. I would recommend DOOR3 to anyone who needs reliable Web design and mission-critical, robust software development.”

Patrick McGill, Director, Online Production CSTV/CBS Online, Inc